Appsaati

FINTECH company for Middle east providing cutting edge Financial technology solutions

READ MORE

Art & Design

Lorem ipsum dolor sit amet, conse ctetuer adipiscing elit.

Leadership

Lorem ipsum dolor sit amet, conse ctetuer adipiscing elit.

Projection

Lorem ipsum dolor sit amet, conse ctetuer adipiscing elit.

Promotion

Lorem ipsum dolor sit amet, conse ctetuer adipiscing elit.

Appsaati was established in 2019, a fintech company providing digital payments solutions.

We enable businesses to accept and manage payments, with more flexibility, security and ease, a full-suite of digital payment solutions, to serve everyone’s need.Getting started is fast and simple.

APPSAATI can be integrated with any business platform to start from sharing payment links through SMS, WhatsApp or any social media platform. POS terminals and SoftPOS for all kind of businesses to have seamless solution with unlimited Credit Card and Debit Card payment options for your payment platform. Integration with your perfect shipping partner is also available with a click of a button.

Our Products

ONLINE PAYMENT GATEWAY (POWERED BY HYPERPAY)

Claritas est etiam processus dynamicus, qui sequitur mutationem consuetudium lectorum. Mirum est notare quam littera gothica, quam nunc putamus parum claram, anteposuerit litterarum formas humanitatis per seacula quarta decima et quinta decima.

PAYOUTS AND MONEY TRANSFER TOOLS (POWERED BY MASSPAY)

Claritas est etiam processus dynamicus, qui sequitur mutationem consuetudium lectorum. Mirum est notare quam littera gothica, quam nunc putamus parum claram, anteposuerit litterarum formas humanitatis per seacula quarta decima et quinta decima.

INVOICING & RECONCILIATION TOOLS

Claritas est etiam processus dynamicus, qui sequitur mutationem consuetudium lectorum. Mirum est notare quam littera gothica, quam nunc putamus parum claram, anteposuerit litterarum formas humanitatis per seacula quarta decima et quinta decima.

FRAUD PREVENTION TOOLS

Claritas est etiam processus dynamicus, qui sequitur mutationem consuetudium lectorum. Mirum est notare quam littera gothica, quam nunc putamus parum claram, anteposuerit litterarum formas humanitatis per seacula quarta decima et quinta decima.

ID E-UPDATE TOOLS

Claritas est etiam processus dynamicus, qui sequitur mutationem consuetudium lectorum. Mirum est notare quam littera gothica, quam nunc putamus parum claram, anteposuerit litterarum formas humanitatis per seacula quarta decima et quinta decima.

ONLINE CONFERENCING TOOL (DIGITALMEET) SIMILAR TO ZOOM, TEAMS, HANGOUTS

Claritas est etiam processus dynamicus, qui sequitur mutationem consuetudium lectorum. Mirum est notare quam littera gothica, quam nunc putamus parum claram, anteposuerit litterarum formas humanitatis per seacula quarta decima et quinta decima.

Our Skills

I am text block. Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Consultancy

39%Funding

54%Investment

78%

Our Services

Online Payment Gateway:

We provide an interface for merchants who wish to take credit or debit card payments.

Point of Sale (POS):

POS is a hardware terminal system for processing card payments at retail location. Software to read magnetic strips for credit and debit cards is embedded in the hardware Providing the convenience of mobility, the POS machine entails and functions through a SIM Card and allows you to accept payments from your customers, over a wireless network.

SoftPOS:

The Software Point of Sale or SoftPoS is a new technology which enables merchants to accept any card payments directly on their phone or devices seamlessly without any third party hardware device.

Recurring Billing:

Enables merchants to accept recurring payments and easily manage subscription-based customers. The solution is flexible and fits with various business models, to meet merchants needs and boost customer satisfaction.

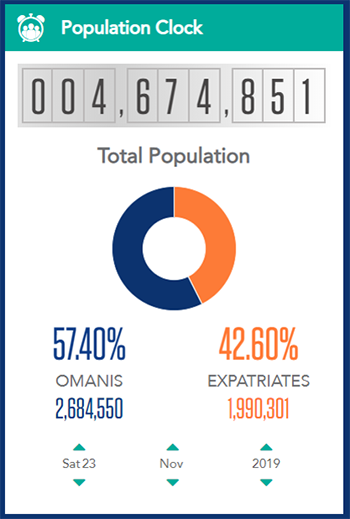

Oman Ecommerce Market

Internet users in Oman

There were 4.66 million internet users in Oman in January 2020. The number of internet users in Oman increased by 727 thousand (+18%) between 2019 and 2020. Internet penetration in Oman stood at 92% in January 2020.

Social media users in Oman

There were 2.80 million social media users in Oman in January 2020. The number of social media users in Oman remained unchanged between April 2019 and January 2020. Social media penetration in Oman stood at 56% in January 2020.

Mobile connections in Oman

There were 6.24 million mobile connections in Oman in January 2020. The number of mobile connections in Oman in January 2020 was equivalent to 124% of the total population.

The Transaction Flow

Placed Order

Customer places an order.

Securely Transfers

Merchant securely transfers order information over the Internet Via an API.

Authorization Request

The transaction detail appropriately and securely routes the transaction authorization request.

Transaction Authorization

The transaction is then routed to the issuing bank to request transaction authorization.

Authorized

The transaction is authorized or declined by the issuing bank or card.

Returns the Message

Returns the message to the merchant via API.

Approval

Issuing bank approves transfer of money to acquiring bank.

Acquiring

The Acquiring bank credits the merchant's account.

Our Business Partners